Warner Music Group (WMG)·Q1 2026 Earnings Summary

Warner Music Beats Earnings, Bets Big on AI with Suno Deal

February 5, 2026 · by Fintool AI Agent

Warner Music Group delivered a strong fiscal Q1 2026, beating revenue expectations by 9.2% and demonstrating margin expansion of 310 basis points year-over-year. Total revenue grew 7% in constant currency, led by 9% growth in recorded music subscription streaming on an adjusted basis. Adjusted OIBDA surged 22% with margin expanding over 300 basis points, marking the company's third consecutive quarter of profitable growth.

CEO Robert Kyncl highlighted the company's strategy of growing share, growing the value of music, and driving efficiency — now being accelerated through AI partnerships with Suno, Udio, Stability, and KLAY.

Did Warner Music Beat Earnings?

Yes — decisively on both revenue and margins.

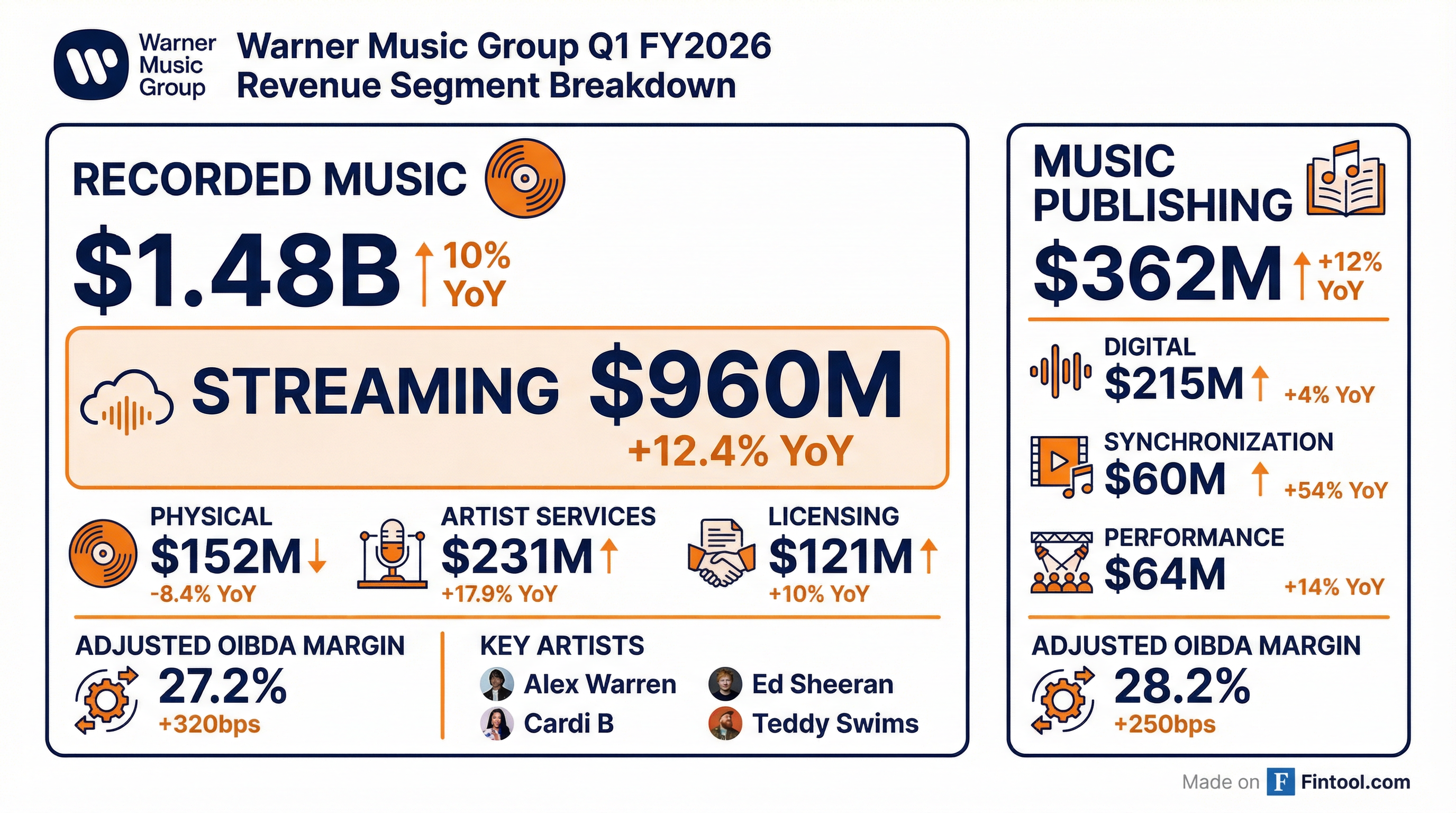

Revenue growth of 10.4% (7.1% in constant currency) was broad-based, with both Recorded Music (+10%) and Music Publishing (+12%) contributing. Adjusted OIBDA margin of 25.2% was up 340bps YoY, driven by restructuring savings, revenue mix, and favorable FX (~$25M benefit).

GAAP net income declined 27% YoY to $175M due to currency-related losses on Euro-denominated debt ($1M loss vs. $61M gain last year) and lower gains on intercompany loans.

What Is Warner Music's AI Strategy?

AI dominated the earnings call Q&A, with management positioning WMG as the most aggressive among major labels in embracing generative AI partnerships.

AI Deal Philosophy

CEO Kyncl outlined three non-negotiable principles for all AI partnerships:

- Licensed models — Partners must commit to licensing, not training on unlicensed content

- Fair economics — Deal terms must properly reflect the value of music

- Artist opt-in — Artists and songwriters must choose to participate in use of their name, image, likeness, and voice

"If you want this market to grow and evolve healthily, it is important to strike the right balance... Finding the shades of gray of the right equilibrium between what the user wants and what we, the rights holders and artists and songwriters, want."

Suno Partnership — Material Revenue Expected FY2027

The Suno deal was highlighted as particularly significant:

- Suno is the market leader in generative AI music with "several hundred million" in annual revenue

- Consumption-based economics — WMG's revenue scales as Suno's platform grows

- Higher ARPUs — Interactive nature of AI platforms drives higher per-user revenue than traditional streaming

- Material contribution expected in FY2027 — WMG expects this to be a "material top and bottom-line growth driver"

CFO Zerza drew parallels to gaming's transition from physical to digital:

"When gaming moved from physical to a digital experience, and gamers started to interact with games more... we had the opportunity to introduce multiple different business models. And that's what our partners are intending to do here."

DSP Conversations on AI Tiers

Management confirmed active discussions with traditional DSP partners (Spotify, Apple Music, etc.) about incorporating AI tools into premium super fan offerings:

- AI functionality could enable "creation as the ultimate expression of fandom"

- Super fan tiers of the future expected to include AI creation tools

- Holistic DSP relationships being considered for AI integration

What Drove the Beat?

Streaming Momentum Accelerating

Total streaming revenue grew 10.7% (7.6% in constant currency) to $1.17 billion.

Recorded Music Streaming (+12.4% YoY):

- Subscription revenue: +14.3% (driven by positive market share trends and chart performance)

- Ad-supported revenue: +7.2%

- Adjusted for one-time items (DSP settlements, BMG termination), growth was 10.9%

Music Publishing Streaming (+3.4% reported, +12.8% adjusted):

- Reported growth was impacted by $17M of MLC Historical Matched Royalties in the prior year

- Underlying growth driven by new deals and renewals

Cost Savings Delivering

Restructuring initiatives are flowing through to margins. SG&A expenses declined 3% YoY despite top-line growth. Management highlighted that a portion of savings has been reinvested into the business.

How Did the Stock React?

Muted — stock finished flat despite the strong beat.

WMG traded in a wide range on earnings day, falling as low as $26.42 (-6% intraday) before recovering to close at $28.16, essentially flat from the prior close of $28.20. The stock remains 23% below its 52-week high of $36.64.

The muted reaction likely reflects:

- Earnings quality concerns — GAAP EPS of $0.33 was down 27% YoY due to FX impacts

- Streaming deceleration worries — Despite strong results, subscription streaming growth slowing from prior peaks

- Physical decline — Physical revenue down 8.4%, a potential headwind

What Did Management Say?

"It's rare to see a company undergo such significant transformation in such a short time frame while delivering accelerated growth and profitability. Yet, we've accomplished just that, and it's a testament to the incredible work of our employees."

— Armin Zerza, CFO, Warner Music Group

"AI is leading to an explosion in creative and commercial possibilities that will create even greater demand for original talent. Shifts in culture and tastes have and will always be defined by real artistry, identity, and vision that define the strongest creative brands."

— Robert Kyncl, CEO, Warner Music Group

Market Share Momentum

Management highlighted consistent market share improvement across regions:

- ~1 percentage point of U.S. streaming market share growth YoY

- +3 percentage points on Spotify's Top 200 chart fiscal year to date

- Number ones in France, Italy, Spain, Netherlands, Finland, Korea, and China

Key releases: Zach Bryan's With Heaven on Top hit #1 on Billboard 200, while Bruno Mars' "I Just Might" reached #1 on Billboard Hot 100 and both Spotify US and global charts. Bruno's new solo album The Romantic drops February 27th.

Segment Deep Dive

Recorded Music ($1.48B, +10% YoY)

Artist Services (+17.9%) was the fastest-growing segment, driven by higher concert promotion revenue in France and favorable FX ($9M benefit).

Top sellers in the quarter included Alex Warren, sombr, Cardi B, Ed Sheeran, and Teddy Swims.

Adjusted OIBDA margin expanded 320bps to 27.2%, driven by restructuring savings and favorable FX (~$18M).

Music Publishing ($362M, +12% YoY)

Synchronization (+54%) was the standout, driven by higher TV and commercial licensing, $3M in copyright settlements, and the Tempo Music acquisition.

Adjusted OIBDA margin expanded 250bps to 28.2%.

What Did Management Guide?

FY2026 Outlook: 150-200 bps of margin improvement, with longer-term targets raised

CFO Zerza provided enhanced margin guidance on the call:

- FY2026: 150-200 bps margin improvement on track

- Short-term target: Mid-20s% margin is "achievable in the short term"

- Longer-term goal: High 20s% margin

"A margin target in the mid- to high-20s is very realistic for our industry."

Growth Accelerants

Management outlined several drivers to accelerate from the current baseline:

- DSP pricing increases — Volume-led growth evolving to volume + value-led growth, with increases starting Q2

- Catalog M&A — Bain JV capacity increased from $1.2B to ~$1.65B, with "exciting announcements coming in the near future"

- Distribution and DTC expansion — Physical merchandising and e-commerce opportunities

- AI partnerships — Material revenue contribution expected starting FY2027

Bain JV Expansion

WMG and Bain increased equity commitments by $100 million each, expanding total JV capacity from $1.2B to approximately $1.65B. Management expects to deploy a "significant portion" by fiscal year-end, targeting high-margin catalog acquisitions in both Recorded Music and Music Publishing.

TikTok Deal Renewed

WMG renewed its deal with TikTok with improved economics and structural changes that "better reflect the value of music." However, TikTok remains in "lower single digits as a percentage of revenue," so not material to overall results.

What Changed From Last Quarter?

Key improvements from Q4:

- Margin inflection — Adjusted OIBDA margin jumped from 21% to 25%, the highest in recent history

- Cash flow surge — Operating cash flow nearly doubled QoQ to $440M

- Third consecutive quarter of broad-based success per CFO

Balance Sheet & Cash Flow

Free Cash Flow increased 42% to $420M from $296M YoY, driven by operating performance and lower capex ($20M vs. $36M).

Capital allocation priorities:

- Quarterly dividend maintained at $0.19/share

- Capex down 44% YoY as tech investments normalize

- Balance sheet strengthening (net debt down $200M+ QoQ)

Q&A Highlights

On why WMG is embracing AI more aggressively than peers:

"There are past attempts in the space of media that kind of prove that black and white doesn't work. The TV Everywhere initiative roughly 25 years ago... didn't work, and allowed companies like Netflix, where I worked at that time, to run faster and gain market share... DRM and music basically slowed down the adoption of streaming services. So we at Warner have learned from the past."

On artist/songwriter response to AI:

"It's been surprisingly high. A lot of artists and songwriters are curious about the future... many of them want to get involved early on. Just the other day, I had two of them visit in the office and talk about how they can get involved."

On capital allocation philosophy:

"We have moved from looking at individual deals to looking at our entire deal portfolio... We have now created a deals office that has a view of all those deals over multiple years, which not only allows us to prioritize the best deals, but also gives us much better visibility about the impact on future revenue, growth, share growth, margin, and cash flow."

On publishing business outlook:

"Over the past five years, we have doubled the business, top and bottom line... We've seen double-digit growth in publishing for the past three quarters. Looking forward, we're really confident that we can continue to deliver double-digit growth."

Key Risks and Concerns

-

GAAP vs. Adjusted Divergence — While adjusted OIBDA surged 22%, GAAP net income declined due to currency impacts. Investors may question earnings quality.

-

Physical Decline Continuing — Physical revenue down 11% due to difficult prior-year comps (Linkin Park releases) and weakness in Japan and Korea.

-

Asia Execution Risk — Management acknowledged Asia as "the place where we have the most amount of work to do," with recent leadership changes in Japan and across the region.

-

AI Revenue Timing — While AI partnerships are strategic, material revenue contribution isn't expected until FY2027, creating execution risk.

-

BMG Distribution Roll-Off — Digital distribution revenue from BMG is rolling off, with ~$10M impact expected in each of Q2-Q4.

Forward Catalysts

- Bruno Mars album release — The Romantic drops February 27th, his first solo album in a decade

- Form 10-Q filing — Expected February 9, 2026

- Catalog M&A announcements — "Exciting announcements coming in the near future" as Bain JV deploys capital

- DSP pricing increases — Contractual increases starting Q2 and layering throughout FY2026

- AI partnership revenue — Material contribution expected starting FY2027

- Strong Q2 release slate — Bruno Mars, Charli XCX, Kehlani, Hilary Duff, Don Toliver, Fred again.., Charlie Puth, Tiësto

Data sources: Warner Music Group Q1 FY2026 earnings call transcript (February 5, 2026), 8-K filing. Market data from S&P Global. Consensus estimates from S&P Capital IQ.